Investors

Investment Strategy

The Las Vegas industrial market is uniquely positioned to attract businesses that are relocating from other states and those that are bringing production and warehousing back to North America from overseas. The pandemic accelerated the exodus of businesses from California and the northeast U.S., and we expect businesses to continue to relocate to low-cost jurisdictions such as Las Vegas. Real estate prices and labor costs in Las Vegas are about one half of California’s, and Nevada continues to be a top relocation destination for California companies.

Most institutional industrial development during this economic cycle has focused on large logistics facilities for e-commerce, which has left Las Vegas with a shortage of supply of smaller warehouses as businesses continue to migrate to Las Vegas. Strongbox Development Company specializes in this smaller industrial product and develops warehouses for sale to end users. In the Las Vegas market, sales to small industrial users typically deliver a 5-10% price premium compared to selling to a real estate investor. Strongbox’s focus on the smaller building niche has delivered outsized margins through this cycle. Strongbox’s exit strategy is to sell the buildings upon construction completion, which creates shorter investment timelines, stronger investment returns, and the flexibility to redeploy capital more quickly into new opportunities.

Series A vs Series B

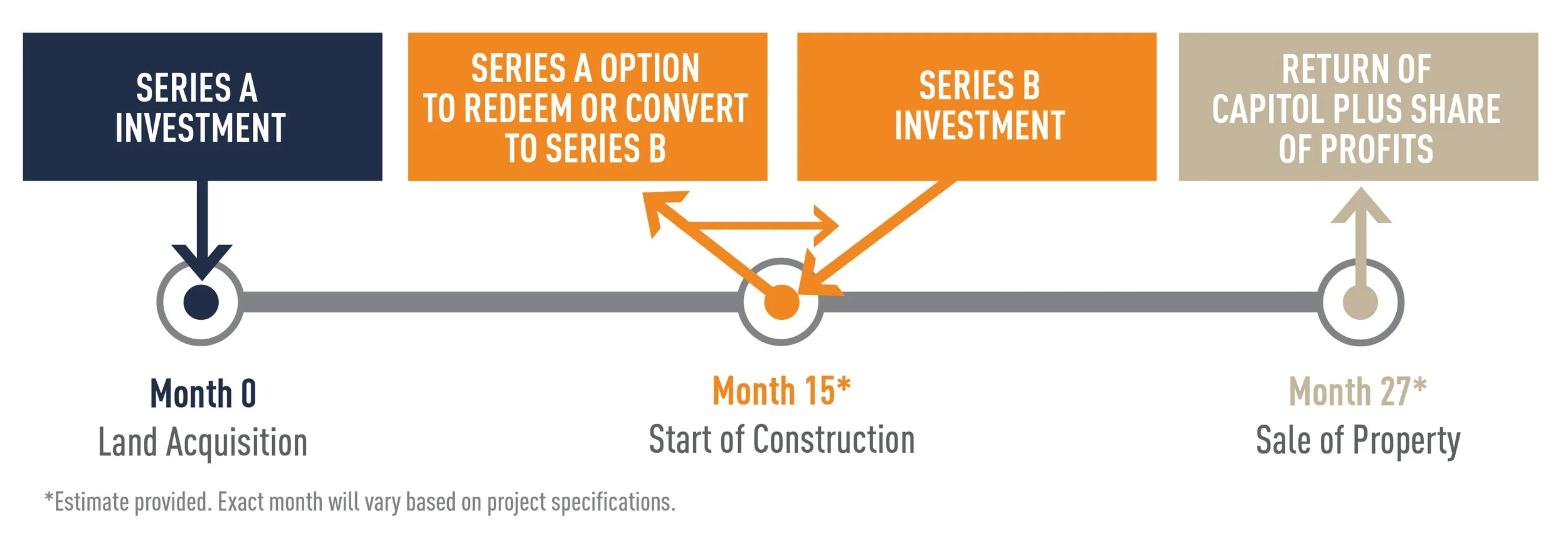

Throughout the lifecycle of a project, we offer two opportunities to invest: Series A and Series B. Series A investors will invest at the beginning of the deal during the land acquisition phase. The money invested goes towards purchasing the land and covering pre-construction costs such as design fees, civil engineer fees, permitting fees, etc. The typical lifespan of this Series A investment is roughly 12 - 18 months depending on the project. At the end of this investment period, which is concurrent with the start of construction, Series A investors receive a preferred return on their investment. At this time, Series A investors are given two options. They can either liquidate, and will receive their initial investment back along with the preferred return. Or, they are given the option to convert their investment plus their preferred return into Series B.

Series A investors are given the first opportunity to invest in Series B, however we also open the opportunity to investors who did not participate in Series A to invest in Series B.

The money raised in Series B goes towards covering the construction costs to complete the building. Upon sale of the property, all investors who participated in Series B receive a share of the profits. The typical lifespan of this investment is roughly 9-12 months, however is dependent on the scope of the construction and when the sale occurs . The preferred return for Series A investors and the profit share for Series B investors are all terms agreed upon in an operating agreement before any money is invested.